$0We're here for every step.Choose the right Quicken for you.

Whether you want to stay on budget or on top of your investments, we make managing your money a snap.

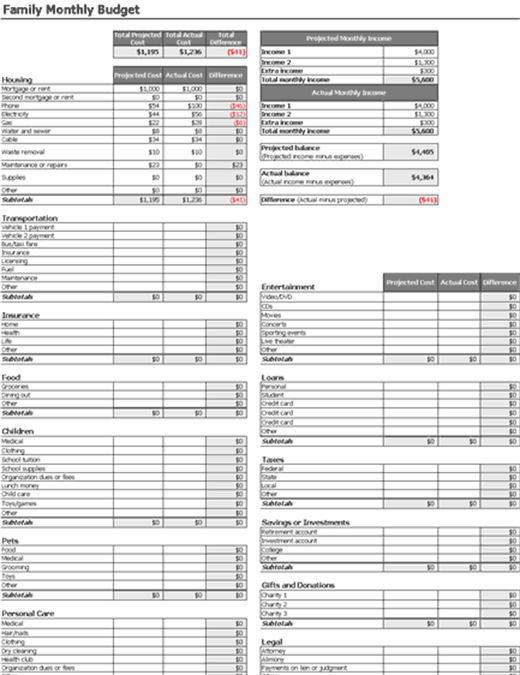

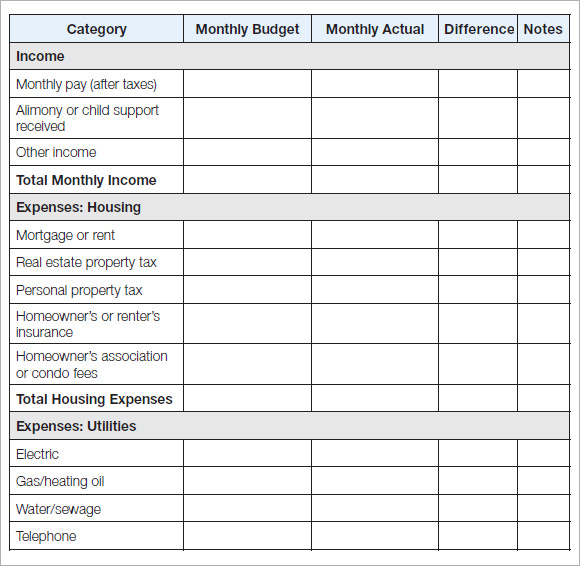

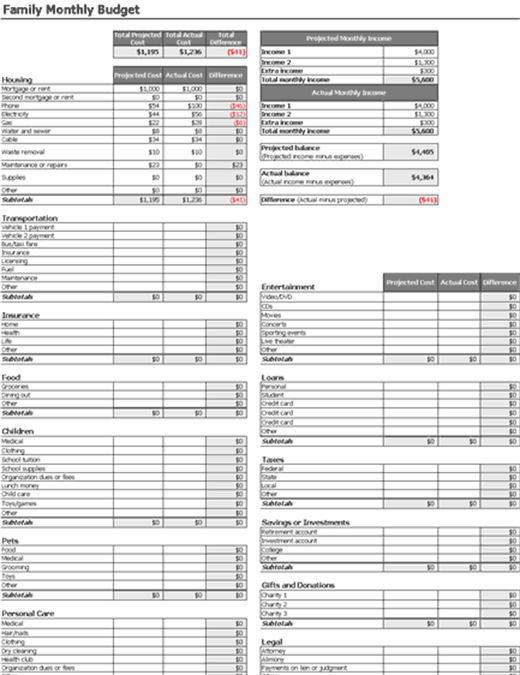

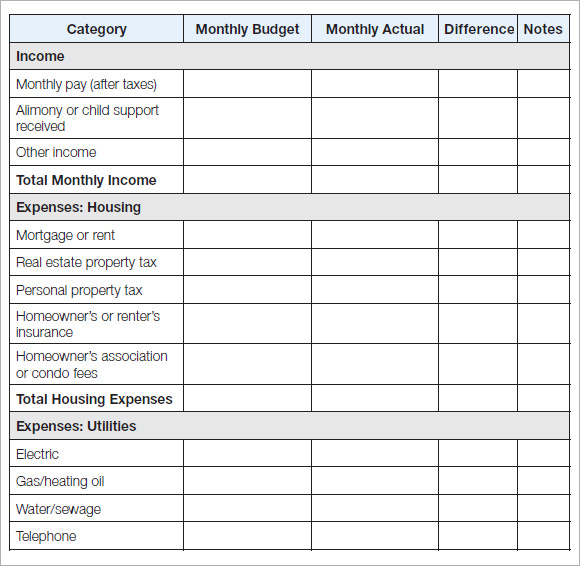

COMPARE QUICKEN PLANSFree Budget Calculator When it comes to personal finance, it's best not to play the guessing game. Sometimes the easiest way to manage your monthly budget is to visualize it. With Quicken's budget calculator, it's easier than ever to manage your finances. Getting Started: Put Together a BudgetTake the time to add up your total monthly income from all sources and list your regular monthly expenses to create a monthly budget. Categorize expenses in groups to make the process simpler. For example, include mortgage payments or rent as well as utilities when you list an amount for housing. Transportation includes not just your car payments but gas, insurance, registration and repairs as well. Quicken's Free Budget Calculator gives you a boost toward getting this done by doing all the math for you. Review Where Your Money GoesHousehold Budget TemplateOne benefit of building a budget is that it forces you to track your spending and see in black and white (or in this case—color) where your money goes. This kind of expense-tracking exercise shows how even little costs add up. Realize Your GoalsCreating a budget forces you to reevaluate your goals and priorities. If you aren't saving money for the things you plan to do, you aren't likely to do them. For example, rather than fantasize about buying a home or going back to school, include contributions to funding these goals in your monthly budget. Emergency Planning: Prepare for the UnexpectedYou can prepare for the unexpected by creating an emergency fund with sufficient cash to carry you through hard times. Your emergency fund should contain enough money to pay your bills for three to six months. Make your 'emergency fund' a budget item and contribute small amounts monthly until the fund is large enough to serve as a safety net. Click below for the free budget template that matches your lifestyle Managing household expenses can seem like a scary thing, regardless of whether you’re living on your own with your partner for the first time, or are an experienced homeowner with kids. It’s important to confront your finances and create an effective household budget to help you get a grasp on your finances and limits. Follow these tips to creating an effective budget for your home and family: 1. Get a Clear Idea of Your Spending Habits You might have an idea of how much you spend each month, but without cold-hard math, you really don’t have a clear indication of how much money is going out. Many people underestimate how much they spend, which can be a dangerous thing when it comes to keeping household finances in order. The best way to identify this number is to keep each and every receipt from all your expenses, and tally up a total. After adding up these numbers, you’ll have an accurate idea of how much you spend. After subtracting all these expenses from your monthly take-home pay, you’ll see right away if what you earn is adequate enough to cover these costs or not. If you end up with a negative number, you know that you’ve got to make some adjustments. 2. Cut Non-Essential Expenses  After completing step 1, if you find that a negative number is calculated, you are most likely overspending. The simple solution here is much easier said than done – you’ve got to slash your spending. In particular, you need to sacrifice expenses from your “leisure” category, such as dining out, entertainment, non-essential shopping sprees, and so forth. As tough as this may sound, it’s only a temporary situation that will help lead you to long-term financial stability. Redirect your leisurely funds towards paying off debt, and getting your final number back into the positives.   Use a simple-to-use home budget template to better understand your finances 3. Review and Revise Your Budgeting Tactics Look over your budget at the end of each month, and identify whether or not any of your habits have changed. This will help you determine whether or not you’re still on track. If you’re not, it’s time to revise your budgeting strategies. Revise certain percentages in your budget, and identify what areas you’re still overspending in. The whole idea behind budgeting is that it helps you manage your money better on your own terms that you’re most comfortable with. As you get a better grasp of your finances each month, things should change for the better. You’ll be able to set more money aside for things such as investments, an emergency savings account, and so forth. Click here to download the XLS filehome budget template.xls. 4. Get Some Help From Online Tools If you’re not too keen on jotting down all your dollars and cents on paper, then try using an effective online tool instead. Using a home budget template in spreadsheet form is a great way to organize your finances so you can clearly see what is coming in and what’s going out. Need an effective, simple, easy-to-use tool to help keep your household expenses in order? Mint.com has all the solutions you need to keep a budget – and stick to it! Visit Mint.com today and take advantage of our FREE budgeting services and tools! Household Budget Template

Household Budget CalculatorSign up for Mint todayHousehold Budget 101From budgets and bills to free credit score and more, you’ll

discover the effortless way to stay on top of it all.

|  BACKNEXT

BACKNEXT